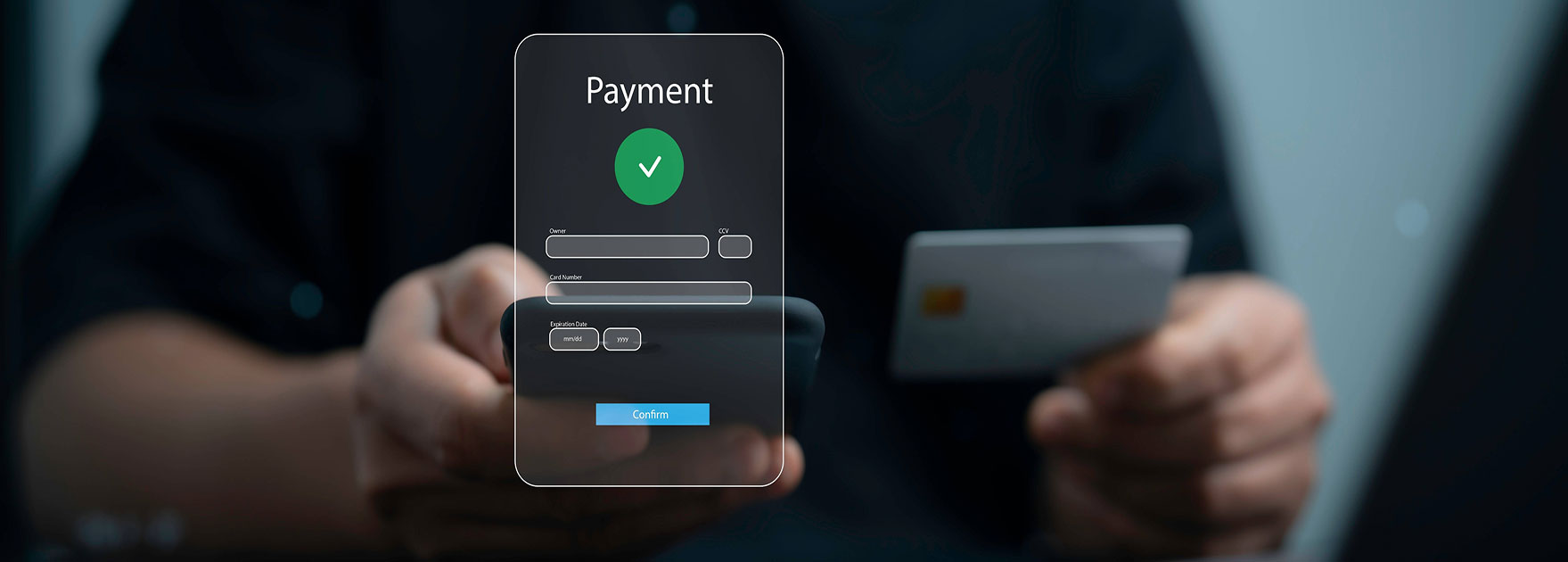

Mobile Banking

Our AI-powered solutions transform mobile banking into a seamless, secure, and

personalized experience that meets the evolving needs of today’s digital customers.

customers prefer

digital management

reduced cost per

transaction compared

to branch

higher customer

satisfaction than

branch banking

Youth Rely on

Mobile as

Their Primary Channel

Designed for These Institutions

COMMERCIAL & RETAIL BANKS

Handling complex corporate portfolios and reducing delinquent loans demands speed and flexibility. Financial institutions need scalable platforms that speed up loan decision processes and strengthen risk oversight.

COMMERCIAL & RETAIL BANKS

DEVELOPMENT BANKS

Large-scale infrastructure and impact projects require transparent, integrated management. Development banks need flexible systems that enhance oversight, delivery and outcome tracking.

DEVELOPMENT BANKS

GOVERNMENT & ECONOMIC DEVELOPMENT

High volumes of enterprise support programs call for digital systems that enable faster turnaround, flexibility, accountability and allow governments to track program success.

GOVERNMENT & ECONOMIC DEVELOPMENT

FUND MANAGEMENT

Managing investment funds and non-bank direct lending requires flexibility and transparency. Fund managers need systems that support customised lending structures, investor oversight, covenant monitoring, and lifecycle reporting to manage risk and protect returns.

FUND MANAGEMENT

SME FINANCE & SUPPORT

SMEs need more than loans - they need partnership and support. Lenders require scalable platforms that speed decisions, manage risk, and help small businesses grow.

SME FINANCE & SUPPORT

FINANCIAL INCLUSION Credit Union / SACCO / MFI

With more customers seeking access to credit, Financial Inclusion providers require digital tools that enhance efficiency, credit assessment, and inclusion for underserved communities.

FINANCIAL INCLUSION

ISLAMIC FINANCING

Sharia-compliant institutions require adaptable platforms that support unique financing models while ensuring transparency, compliance, and faster service delivery.

ISLAMIC FINANCING

MORTGAGES

Borrowers expect quick, transparent home financing. Lenders need digital platforms that reduce process bottlenecks, speed approvals, and simplify loan management across growing portfolios.

MORTGAGES

Bank Anywhere, Anytime

Deliver seamless financial access to your customers through a secure and intuitive mobile platform. Empower users to transact, save, and stay connected with their finances—wherever they are.

Products Under

This Solution

-

Abacus

-

Baytree